The State of EMV: The Good, the Bad & the Future

How Does the Technology Stack Up as Mid-2017 Approaches?

More than a year and a half after the EMV liability shift, reports suggest that chip cards are making substantial progress toward comprehensive adoption. However, does the information really reflect the facts on the ground? What is the technology’s actual progress, and what is the future of EMV?

The Chip Card Progress

The payments industry continues to make steady progress toward an end-goal of comprehensive EMV compliance.

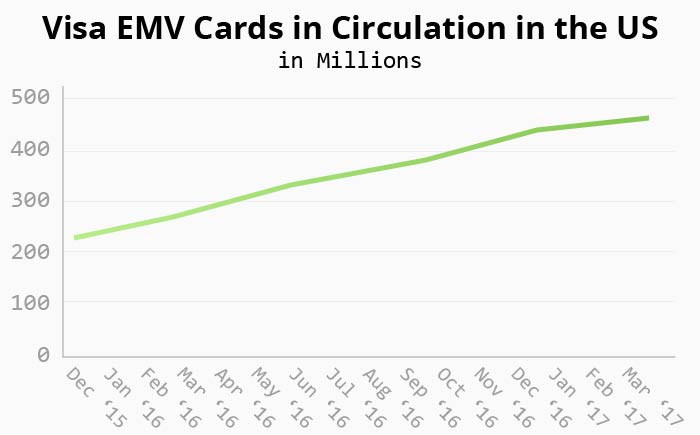

Data shows the number of Visa cards in US circulation increased by 159% between March 2016 and March 2017. Roughly 421.1 million Visa cards—58% of all those in circulation throughout the country—now feature EMV chips. Similar results were observed by other card brands, with 63% of all cards in the US market now EMV-ready.

Total counterfeit card losses assumed by merchants who completed the move to EMV compliance dropped by 58% between December 2015 and 2016.

While this does reflect improvement, EMV technology is still not where it needs to be.

Positive Statistics Hide Lackluster Reality

Following the October 2015 fraud liability shift, the financial responsibility for chip-enabled cards moved from card networks to merchants. This makes tracking adoption rates among merchants a more relevant gauge of the technology’s real progress.

Unfortunately, only 44% of US storefronts are currently capable of accepting chip cards—a very modest gain over the last six months.

Merchants’ slow progress becomes a footnote as card networks and cardholders push ahead. Of course, merchants can only adopt as fast as they can secure certification, meaning there is little they can do to protect themselves beyond strict adherence to fraud prevention and best practices.

While card-present merchants are left behind in the move for EMV adoption, problems are even greater in the card-not-present environment. There is hardly any protection against counterfeit fraud for CNP merchants; sellers are totally reliant on their own resources to stop attacks, yet they face the same penalties as card-present merchants.

The fact that the EMV liability shift at gas pumps was pushed back to 2020 further complicates matters.

Automatic fuel dispensers at gas stations were already a favorite target for fraudsters even before EMV technology began rolling out. Now AFD merchants have less incentive to speed-up their own transition, making the machines an easy target for customer data.

What’s in Store for the Future of EMV?

The benefits of EMV technology has impacted merchants, institutions, card networks and consumers in an uneven manner thus far. Will things get better any time soon?

Faster Authorizations

Upgrades to EMV software promise to make the chip authorization process as fast as possible. This provides cardholders with an improved customer experience, while also saving time and money for EMV-enabled retailers.

Biometric EMV Cards

Card networks have explored the idea of introducing biometric technology into the payment process for years. With successful tests of Mastercard’s biometric fingerprint cards earlier this year, that long-term goal may be just around the corner.

The Rise of Mobile Payments

Mobile apps like Apple Pay and Samsung Pay are growing at a slow-but-steady pace. This is a rare bit of positive news for CNP merchants, as mobile payment apps utilize the same tokenization technology as EMV cards, along with biometric security to dramatically reduce the chances of criminal fraud.

AFDs Continue to Serve as a Pain Point

Converting a single gas pump to be EMV-compliant can cost more than $10,000, and nearly a third of the nation’s 750,000 gas pumps would need to be replaced by newer models entirely. The likely result is that AFDs will be a major security liability for several years to come, as most retailers haven’t even started the process of adopting EMV technology.

CNP Merchants Continue to be Left Behind

Despite consumers’ increased reliance on eCommerce, card networks will continue focusing their attention on security in the card-present environment. The onus is on merchants to protect themselves from fraud, since minimal new support can be expected from the industry.

EMV: A Work in Progress for the Foreseeable Future

The situation still looks bleak for merchants in terms of security. For card-present merchants, at least there is a promise that EMV technology will eventually provide some support.

CNP merchants, though, do not enjoy that assurance. Increasing interest in mobile payments is good news for eCommerce sellers, but the technology is still too young and too underrepresented to make a serious impact on fraud.